26+ Home equity line of credit

As the Federal Reserve has lifted short-term interest rates in the late 2010s many homeowners who typically opted for the cash-out refi option in the prior decade became more inclined to use a home equity loan or line so they keep their existing low rate on the majority of their home debt. A home equity line of credit is another loan product based on your homes equity but allows you to make multiple draws over time up to a set limit.

Employee Relocation Resignation Letter How To Create An Employee Relocation Resignation Letter Downl Resignation Letter Employee Relocation Letter Templates

SpencerFlex Line of Credit 6500.

. A Home Equity Line of Credit HELOC is a revolving line of credit funded by the amount of equity you have in your home. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Apply now and get an introductory 324 variable interest rate for twelve months and as low as 550 variable thereafter.

Although many customers use a Home Equity Line of Credit for home improvements it can be used for practically any type of expense. Connexus Credit Union 2022-06-07T112619-0500. Tap into the equity in your home to fund your vision with SECUs low-rate Home Equity Line of Credit.

Then as the COVID-19 crisis struck interest rates crashed to the floor shifting homeowner. A home equity loan is a lump sum of cash thats taken out as a second mortgage against your homes equity. Share this page.

Note though that HELOCs typically have variable interest rates meaning your monthly payment is likely to change over the years you are paying it back. NMLS 421318 Routing Number. A Home Equity Line of Credit serves as a ready source of funds for many types of planned and unexpected expenses.

Home Equity Loan vs. 5 15 years. Requirements for a home equity loan or HELOC in 2022.

Compare rates from multiple lenders. 10 The index is the 26-week Treasury Bill rate set at the first auction held on or after the 15th day of the second month of the previous calendar quarter adjusted up. A borrower can take out an equity loan or.

A home equity line of credit HELOC is a revolving source of funds much like a credit card that you can access as you choose. Home equity loans and home equity lines of credit HELOCs are loans that are secured by a borrowers home. 1 payment of 35626.

Home equity line of credit HELOC Type of interest. American Research and Development Corporation. The home must be a double-wide or larger in some cases at least 600 square feet.

The bank serving consumers and businesses operates 26 Financial Centers throughout New Jersey. There must be equity in the home meaning the first mortgage is no more than 80-90 of the homes market value. Serving customers in Bergen Passaic Union and Morris County NJ.

107 56 signed into law October 26 2001 requires all financial organizations to obtain verify and record information that identifies each. This allowed him to use the equity in his current home as the down payment for his new home. Think of it like a credit card with a limit determined by your homes equity typically with a much lower rate than a credit card.

While some banks and credit unions are localized in one state or region Connexus serves all 50 states through a co-op. To qualify for the introductory rate you must have a full check direct deposit to a SECU checking account. July 26 2022 9 min read.

Can I get a home equity line of credit HELOC with bad credit. The loan is secured on the borrowers property through a process. A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt.

Home equity line of credit HELOC rates for loans with a 10-year repayment period are holding steady at 549 for the third straight week according to Bankrate data from the week ending August 1. Home equity line of credit. A Home Equity Line of Credit is a secured open-end loan that unlocks the value of your home allowing you to borrow against the equity credit line worksheet payment schedule.

Stock Market News - Financial News - MarketWatch. Click Play to Learn Everything You Need to Know About Home. It was not until after World War II that what is considered today to be true private equity investments began to emerge marked by the founding of the first two venture capital firms in 1946.

Home insurance also commonly called homeowners insurance often abbreviated in the US real estate industry as HOI is a type of property insurance that covers a private residenceIt is an insurance policy that combines various personal insurance protections which can include losses occurring to ones home its contents loss of use additional living expenses or loss of other. Check our current HELOC rates and use our home equity line of credit calculator to see what you may be able to borrow based on the value of your home. Home equity loan.

You can use it to pay for renovations tuition consolidate higher interest rate debt or finance. This was enough to cover the 20 percent down. In most cases the following requirements must be met before a mobile home equity loan or line of credit is approved.

Home equity loans are available in 48 states but the lender does not offer home equity lines of credit HELOCs at all. Information about the current home mortgage rates and home equity rates in New Jersey. Work with our experts to find the right product for you.

It allows home owners to borrow against. For Discovers home equity loans possible loan amounts range from. 450 for 6 months 2 499 thereafter Interest-Only HELOC.

ARDC was founded by Georges Doriot the father of venture capitalism founder of INSEAD. The Johnsons were approved for a 100000 line of credit. Home Equity Line of Credit HELOC 449.

Why Bethpage Federal Credit Union is the best home equity line of credit with a fixed-rate option. Federal law USA Patriot Act Title III of Pub. Monthly income or a line of credit through a reverse mortgage without having to.

Bethpage offers the unique option to convert some or all of a variable-rate HELOC to a fixed-rate. A Prepayment fee of 350 will be charged if the loan is paid off. Why Connexus Credit Union is the best home equity loan for a branch network.

See our lowest available rates for all Home Equity Loans and Lines of Credit. July 26 2022 9 min read.

45 Loan Agreement Templates Samples Write A Perfect Agreement Contract Template No Credit Loans Loan

26 Inspiration Image Of Shirt Sewing Pattern Figswoodfiredbistro Com Shirt Sewing Pattern Sewing Patterns Butterick

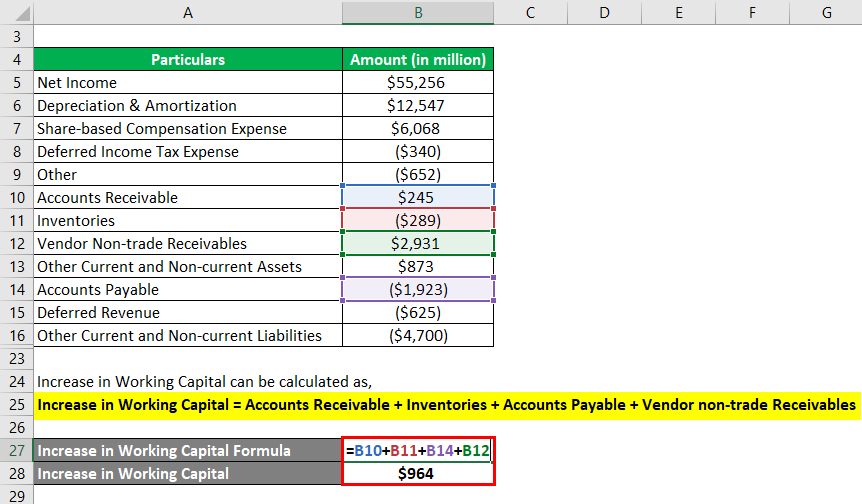

Operating Cash Flow Formula Examples With Excel Template Calculator

Net Credit Sales Importance And Example Of Net Credit Sales

26 Best Teacher Resumes Free Premium Templates

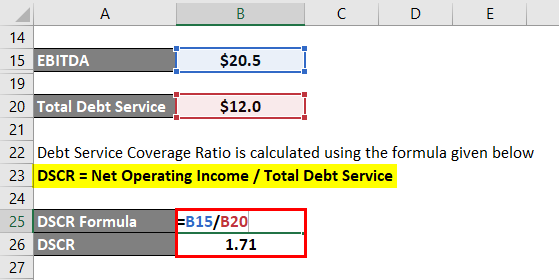

Debt Service Coverage Ratio Calculate Dscr With Practical Examples

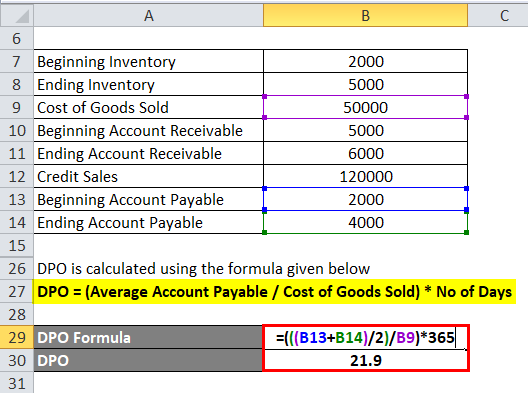

Cash Conversion Cycle Formula Calculator Excel Template

Employee Relocation Resignation Letter How To Create An Employee Relocation Resignation Letter Downl Resignation Letter Employee Relocation Letter Templates

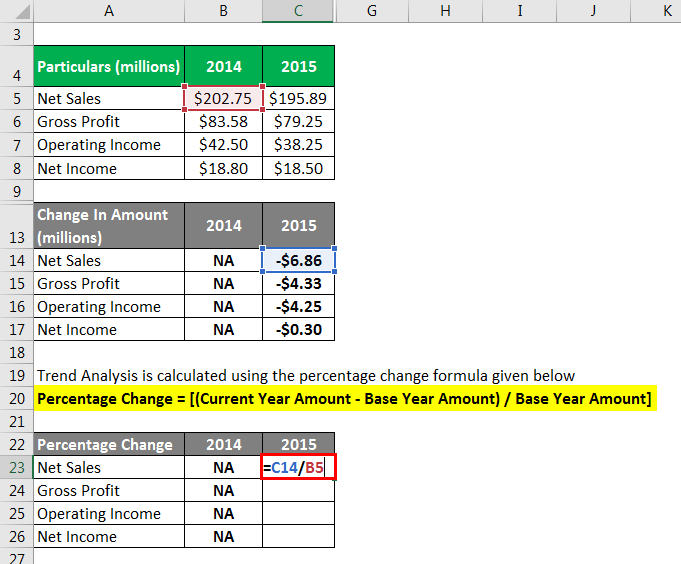

Trend Analysis Formula Calculator Example With Excel Template

Use Our Free 5 Loan Agreement Templates To Get The Best Samples Of Loan Agreement These Agreements Will Hel Contract Template Word Template Proposal Templates

Sec Filing Patria Investments Limited

Loan Agreement Template Format Free 26 Great Loan Agreement Template Loan Agreement Template Is Needed As References Contract Template Loan Personal Loans

26 Great Loan Agreement Template Contract Template Loan Best Loans

Lissette Colon Real Estate Facebook

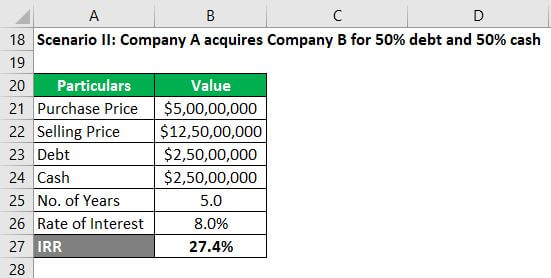

Leveraged Finance Effects Of Leveraged Finance With Example

Realtor Business Plan Template Luxury Free 7 Sample Retail Business Plan Templates In Retail Business Plan Template Business Plan Template Retail Business Plan

Sec Filing Patria Investments Limited